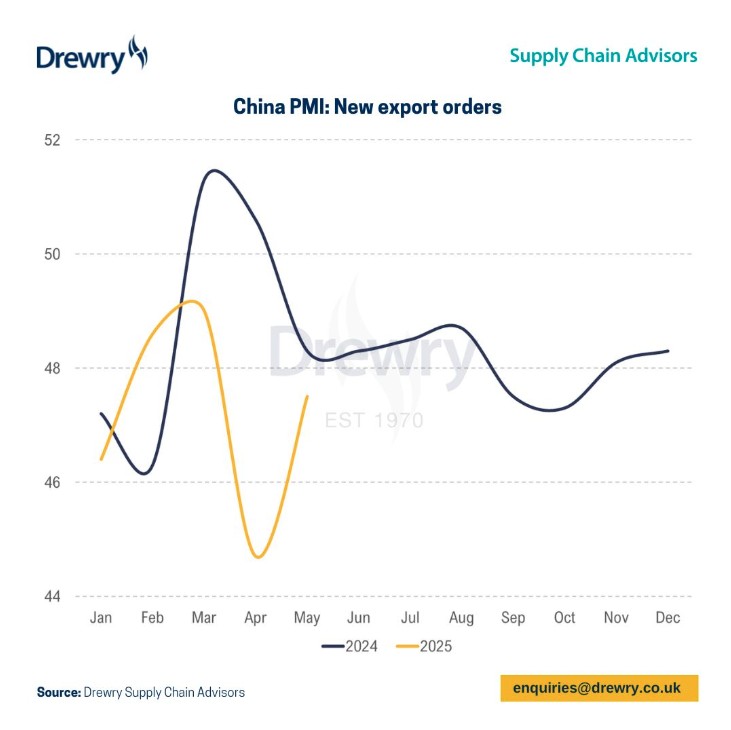

According to Caixin & S&P’s manufacturing Purchasing Manager’s Index (PMI), although China’s manufacturing activity in May was the lowest ever since September 2023, at the same time the sub-index of new export orders rose 3 points to 47.5 compared with April.

In short, Chinese companies are starting to export goods to the US again after the announced 90-day truce on reciprocal tariffs.

Experts point out that this index acts as a key indicator for the entire manufacturing economy, warning that if it falls below the 50-point mark, it means there’s a downturn and shrinking new orders.

The 47.5 points in May, however, show an initial inversion of the downward trend recorded between March (49 points) and April (44.7).

“This latest forward-looking indicator of trade and shipping activity from China suggests that the current rebound in shipping volume from China will not last,” says Drewry managing director Philip Damas, who adds: “The shipping sector recently experienced double-digit increases in spot and contract freight rates from China in May. We estimate that supply-demand in the container shipping industry rose sharply between April and May.”

According to another expert, Getz Pharma export director Hanif Ajari, the rise in China’s new export order PMI to 47.5 is not indicative of a turnaround, but rather a temporary respite before the decline resumes. He said that although the recent increase in shipping volumes and freight rates may seem encouraging, the underlying demand signals remain fragile. He points out that true trade resilience is not based on temporary tariff breaks or short-term rate spikes, but on sustained global demand and supply chain stability.

Translation by Giles Foster