The imminent application of the US Trade Representative (USTR) ship levies will have serious economic repercussions both for non-Chinese shipping companies with Chinese-built vessels in their fleets and for Chinese liners (such as COSCO and OOCL), which will be forced to pay an extra tariff the first time they call at a US port, regardless of where their vessels were built.

To solve this critical issue, companies that can afford to do so, i.e. non-Chinese companies, are trying to relocate Chinese shipping from routes to the United States.

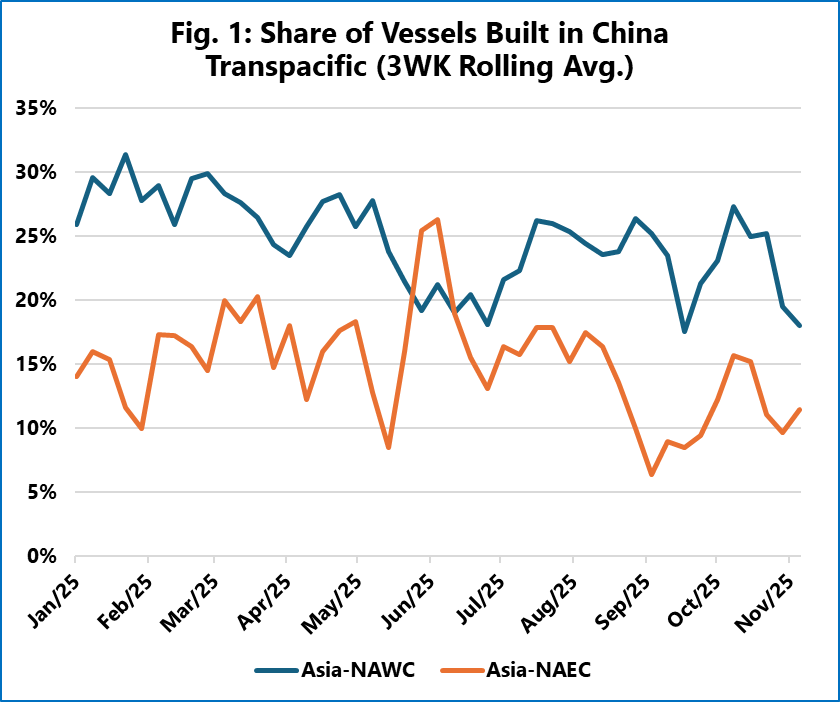

To assess any changes, Sea Intelligence has been monitoring the vessels deployed weekly on the transpacific and transatlantic routes throughout 2025, mapping each vessel according to the shipyard it originally came from, calculating the share of vessels built in China on a 3-week average, so as to identify any underlying trends as we approach the date when the new levies will be introduced.

On the transpacific route, there are already signs of a reduction of vessels made in China. As shown in Figure 1, for the Asia-North America trade lane, the share of Chinese-built ships has been declining, down 25-30% in the first half of 2025 and 20-25% over the last few weeks. A similar tendency, albeit less pronounced, can be observed on the Asia-North America trade lane, along the eastern route.

On the other hand, there does not appear to be any such trend on the transatlantic trade lane yet. Data on scheduled services, both from Northern Europe and the Mediterranean to North America, does not currently support the idea that there is a widespread withdrawal of Chinese-built vessels on the transatlantic route. Although some ships are being relocated, the number is not enough to have a significant statistical impact on this trade lane.

Translation by Giles Foster