Worsening economic conditions and increased uncertainty have led to a slowdown in world trade, especially during the second half of this year, conditioning the volume of containers handled globally, although not at the level that might have been expected, according to the analysis company Alphaliner.

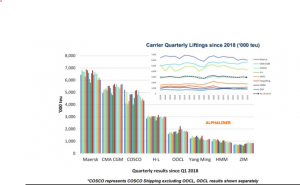

In a recent report it points out that the top eight shipping companies operating in maritime container transport handled 70.8 million TEUs between January and September, – 4.6% on the same period last year.

However, out of the eight big carriers analyzed (Maersk, CMA CGM, COSCO, Hapag-Lloyd, OOCL, Yang Ming, HMM and ZIM), three maintained, more or less, the same traffic volumes they had had in 2021.

These were for Hapag-Lloyd, CMA CGM and Yang Ming. The first two handled respectively 16.59 and 8.98 million TEUs, while the Taiwanese carrier even reported a 4.2% increase in volumes (3.45 million TEUs) compared to January-September 2021. This result was mainly due to the powerful increase in capacity the liner injected into the market as of October 2021, with seven new vessels of over 11,000 TEUs each entering the trade.

Although the outlook remains uncertain due to lower economic growth and commodities costing a lot more, freight rates are still higher than pre-pandemic levels and shipping companies are continuing to place new orders in view of of acquiring new capacity and thus increasing their market share.

At a time when the balance is tied more to the amount of capacity that will gradually be withdrawn from the market (scrapping and blank sailings), the acquisition of additional vessels by liners, however, risks having a negative impact on the resilience of the entire sector.

Alphaliner claims that the orderbook for new containerships is reaching a record 1,000 vessels. The consultancy firm pointed out that if all the orders reported were to be successful, this would mean a total of 8 million TEUs, around 35% of current global capacity.

Splash247 reports that at least three of the top ten shipping companies have recently announced new orders from Asian shipyards. Evergreen Marine, for example, is negotiating a series of newbuildings with a capacity of between 15,000 and 17,000 TEUs while CMA CGM has announced that it will double its current order of six new 15,000 TEU vessels from China’s Dalian Shipbuilding Industry Co. in June.

“The current collapse in demand is to some degree temporary as it is driven by an inventory correction,” says Vepucci Maritime CEO Lars Jensen. He points out that this means that in the coming months, demand may even return to an upward curve.

In Mr. Jensen’s opinion, the problem is that the long-term economic outlook points to a modest growth in trade and, therefore, in demand for maritime transport. How then will the market absorb all this new capacity? Carriers are clearly “heading into problematic territory.”

Translation by Giles Foster