Maersk has just recently taken another important step towards shipping sector decarbonization. The 16,592 TEU capacity containership Ane Maersk has set off on its maiden voyage to Ningbo.

This is the second methanol boxship in the world. The first ever, the smaller Laura Maersk (2,136 TEUs), went into service in September 2023, immediately after its christening ceremony in Copenhagen, the final leg of an inaugural voyage from the South Korean Hyundai Mipo shipyard. The vessel currently operates on a Baltic Sea route between Northern Europe and the Gulf of Bothnia.

The Ane Maersk will be deployed on the AE7 service which connects Asia and Europe.

The Danish shipping company has ordered a total of twelve 16,000 TEU and six 17,000 TEU dual-fuel vessels. Hyundai Heavy Industries’ shipyards has been commissioned to build them. They are due to be delivered in 2024 and 2025. The carrier also has a further six 9,000 TEU vessels on order from Yangzijiang Shipyards in China, scheduled for delivery in 2026 and 2027.

To meet the demand for green fuel, the Danish group has decided to set up a new company, C2X, to pursue large-scale production of green methanol.

With Maersk playing a major role in promoting green methanol as an alternative fuel to traditional ones, other carriers have begun to follow suit.

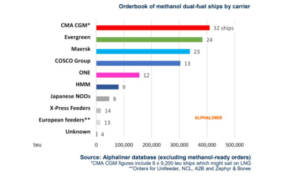

According to Alphaliner data, the total number of green methanol-fuelled dual-fuel vessels on order currently stands at 152, with an overall capacity of 1.75 million TEUs. Shipping company CMA CGM has commisioned the largest number, an impressive 32, followed by Evergreen, with 24 dual-fuel ships on order. Maersk has stopped at 23. However, the Laura Maersk and the Ane Maersk, already delivered, were not included. Cosco and One come in fourth and fifth, with 12 and 9 ships on order, respectively.

Maersk, meanwhile, has disclosed its 2023 financial results. Last year the company’s revenues fell by 37.7% to $51.1 billion, with its EBIT down by over 80% to $3.9 billion and a net profit of $3.8 billion.

Maersk CEO Vincent Clerc said that 2023 was a year of transition. He pointed out that the company had achieved solid financial results despite circumstances having changed significantly and were well placed to handle the expected difficulties in 2024, stressing that the current market continues to be characterized by large volumes. Although the Red Sea crisis has temporarily affected available vessel capacity by increasing freight rates, Clerc remains convinced that the market will continue to be unbalanced on the supply side. Overcapacity will keep freight rates under pressure and will have an impact on carriers’ financial results.

AP Moller-Maersk’s forecast for 2024 sees an EBITDA between one and six billion, an underlying EBIT between – 5 and 0 billion and a negative cash flow of at least 5 billion. The guidance for 2024 is based on a forecast of containerized cargo volume growth of between 2.5% and 4.5%.

Translation by Giles Foster