Import volumes are increasing but, at the same time, the number of available dockworkers is decreasing, due to the spread of the pandemic. This inevitably leads to congested quays and storage areas, literally filled with containers that have to wait for days, if not weeks, before they can be “processed” and returned empty on back-haul trips.

This is the dramatic scenario that two busy ports on the American west coast, Los Angeles and Long Beach, have been experiencing over the last few months, at the top of the list of the most “clogged up” ports of call in the United States.

This is what Alphaliner claims: “Over 1,000 dockworkers in California tested positive for Covid-19 at the start of this week, up from 694 cases on 17th January,” says the consultancy firm.

The analysts point out that since February 1st, 41 container ships have been at anchor in San Pedro Bay waiting to berth in one of the two ports. This would represent a temporarily “immobilized” hold capacity of 336 thousand TEUs, which must be added to the hold capacity of the vessels already berthed since February 1st. This brings the total to 579 thousand TEUs.

Waiting times for “processing” a ship have now well exceeded one week. In order to continue to guarantee the weekly frequency of their services, many carriers have been forced to add extra ships to the congested shipping routes.

There is not enough space available ashore, an insufficient number of containers to return empty to ships for backhaul trips, a lack of tonnage that can be used to ensure many scheduled services can fully operate.

For shipping companies, the economic damage caused by the cancellation of certain sailings, due to a temporarily lack of available tonnage, is far from negligible. A ship transporting 4,000 40-ft containers (with a spot cargo between Shanghai and Los Angeles) makes 16 million dollars just on the outward voyage)

According to Alphaliner, the 29 transpacific services serving Los Angeles and Long Beach have been given an extraordinary boost with the number of vessels being doubled: to be precise, seven 14 thousand TEU container ships, 15 8/11 thousand TEU neo-panamax vessels, and seven 3400 and 6500 TEU units, with an extra $1.42 million per day in charter costs.

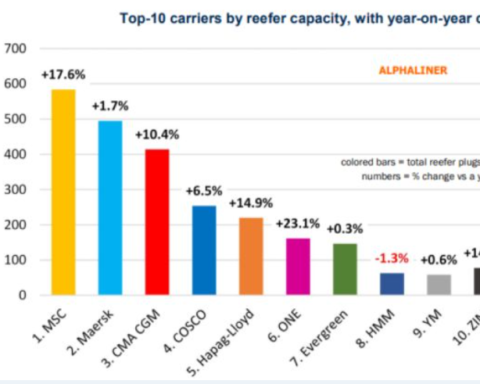

Over the past six months, nearly all shipping lines, with the exception of ONE, have added capacity on the transpacific trade route. MSC, for example, has increased its weekly hold capacity used on routes between Asia and North America by 81.4%.

Translation by Giles Foster