The Chinese New Year is just around the corner. The traditional holiday, which this year begins tomorrow and ends on February 26th, will be celebrated at a particularly delicate time for shipping.

As we already reported, the congestion of quays and storage areas in ports in many countries, literally crammed with containers, has led to serious disruption in the logistics chain, with a visible deterioration in the level of reliability of both ports and carriers, whose scheduling has not been respected.

This very grim scenario is now depicted in Ocean Insights’ latest report and taken up by Lloyd’s List. It shows that, from January 2020 to January 2021, almost one in four containers were not loaded on schedule due to port congestion and had to wait for the next ship to be embarked.

In January, the rollover rate at the world’s top ports was up to 39%; 9 % more compared to January 2020. This marks an increase of two percentage points over last December.

In China, their New Year festivities risk exacerbating an already critical situation. Restrictions imposed by Chinese authorities to cope with the pandemic crisis are creating new bottlenecks in the goods supply chain. Demand for shipments is still on the rise while the additional hold capacity used to meet shippers’ demands does not seem to be having the desired effect for the time being.

In the PRC, getting products to markets is becoming increasingly difficult, not least because of the forced quarantine measures which hauliers who have decided to return home for the holidays are subject to. In some regions of China, especially in the south, up to 95% of truckers will be unavailable.

The situation also affects the reliability of carrier scheduling since many ships are still stuck in the harbour or alongside the quay, at destination ports waiting to be processed. The average delay for delivering a container to ports has increased from one to five days.

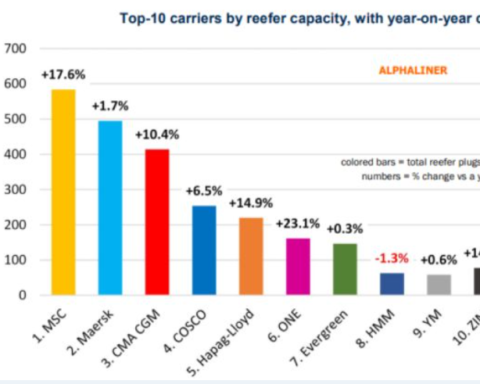

Ocean Insights says that the rollover percentage has been increasing for nearly all shipping lines. CMA CGM is among the shipping lines that have reported the highest average of shipments remaining ashore awaiting subsequent embarkation: 51% of the total. Maersk, on the other hand, has increased from 24% in January 2020 to the current 38%.

Translation by Giles Foster